LiDAR Giant Suffers 65% Plunge

Advertisements

In recent times, the world of automotive technology has witnessed seismic shifts, particularly with the emergence of advanced driver assistance systems (ADAS) and autonomous driving technologies. A significant player in this arena is the LiDAR (Light Detection and Ranging) sector, where one company, Robosense, experienced a dramatic decline in stock value, plummeting nearly 65% as of July 5. This serves as a stark reminder of the volatility and competitiveness inherent in this industry.

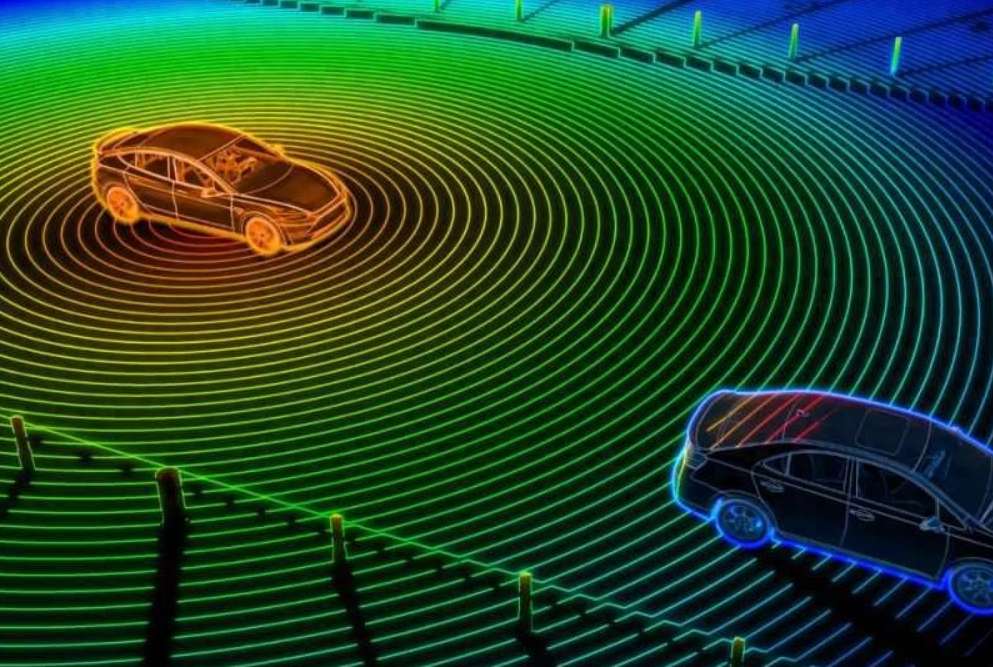

With the automotive industry transitioning towards smarter, more automated solutions, intelligent sensors are at the forefront of this change. These sensors serve as the gateways to vehicles' perception capabilities. The main contenders in the domain of environmental detection include cameras, ultrasonic sensors, millimeter-wave radars, and LiDAR, which paves the way for ongoing discussions around the different paths these technologies can take. Factors to consider when deliberating on sensor selection encompass reliability, performance, and cost, making it a multidimensional decision-making process.

At present, two primary approaches exist in the market. One is characterized by a vision-first methodology, spearheaded by companies like Tesla, which relies predominantly on cameras for vehicle perception. The other approach integrates multiple types of sensors, including cameras, millimeter-wave radars, and LiDAR, aiming for a more comprehensive detection strategy.

Cameras boast a notable advantage in the automotive sensor landscape. They are widely adopted and are capable of distinguishing color variations among objects, thus offering detailed visual perceptions at a lower cost. However, the limitations of cameras are prominent; their performance may falter in adverse weather conditions, they have a relatively short detection range of approximately 10 meters, and their effectiveness diminishes at night.

The pure vision model requires a foundation of vast data sets and significant computational power, presenting practical challenges despite its seemingly straightforward premise. Tesla's business model highlights how scale can make a difference in this competitive arena, but it's crucial to recognize that the sight-based approach has been scrutinized due to algorithmic misjudgments implicated in several autonomous driving incidents.

Other sensor technologies also present a mixed bag of advantages and drawbacks. For instance, ultrasonic sensors are cost-effective and compact, leveraging mature technology. However, they lag behind their counterparts, with a significantly limited detection range of under 10 meters, making them suitable mainly for parking assistance scenarios while lacking the capability to accurately determine the shapes of obstacles.

In contrast, millimeter-wave radar positions itself as a formidable competitor against LiDAR in performance terms. Its strong penetrating ability ensures less impact from adverse weather, offering a detection range exceeding 150 meters, comparable to low-wavelength LiDAR. The rapid response time combined with a lower price point underscores its cost-effectiveness, with market researchers indicating that the cost for millimeter-wave radar in high-end smart cars stands at approximately 1423 yuan, starkly lower than the 5756 yuan for LiDAR.

However, millimeter-wave radar does come with its limitations. Its resolution is constrained, making it challenging to identify specific object shapes, which can inhibit applications beyond adaptive cruise control systems designed to regulate vehicle speed and maintain safe distances.

LiDAR, on the other hand, excels in detection range, precision, resolution, response time, and nighttime performance. These attributes make it well-suited for high-end urban advanced driver-assistance systems like NOA (Navigate on Autopilot). Notably, automakers like BYD have begun to embrace LiDAR technology, equipping their premium models such as the Tengshi N7 and Yangwang U8 with this advanced sensor type while increasing investments in research and development.

Despite its advantages, LiDAR incorporates a significant drawback: its cost. The price differential places it predominantly within the domain of luxury vehicles, those priced at over 300,000 yuan. This aspect stirs debate within the industry regarding its future viability, especially with the advent of other innovative technological routes such as 4D millimeter-wave radars threatening to challenge its supremacy.

The future of this sector appears to be bustling with contention, as rapid technological iteration is vital for companies aiming to maintain their competitive edge. As costs decrease and the penetration rate of advanced driver-assistance systems increases, LiDAR could see wider usage in more affordable vehicles. Some analysts project that the market could expand into trillions, although these forecasts will require careful observation to materialize.

Shifting our focus to the current market landscape, key players have emerged and evolved. Hesai Technology has been able to claim a significant portion of the market, rising to a leadership position. The past couple of years have shown dramatic changes within the LiDAR industry’s pecking order. Once the domain of major overseas manufacturers, the market saw a series of exits, including the departure of pioneering companies like Velodyne and Ibeo, creating opportunities for firms like Valeo, who at one point commanded over 70% of market share.

The year 2022 marked a crucial turning point in this landscape, as Chinese manufacturers began to surge, with Hesai exemplifying this trend. According to data from Yole, Hesai's global market share climbed from a mere 3% in 2021 to nearly 50% in 2022, while Valeo faltered to a 25% share—a dramatic decline illustrating the rapid changes occurring.

Recent reports from market research groups such as Yole Group highlight the 2023 rankings of leading automotive LiDAR manufacturers, where Hesai secured a 37% share, followed by Robosense at 21%, Innovusion at 19%, and Valeo at 10%. Chinese manufacturers are now dominating the market, collectively accounting for an incredible 84% of the global automotive LiDAR market share.

It’s evident that the LiDAR sector has transitioned from a nascent stage to a clear trajectory for development. With the pathway guiding the shift from mechanical to solid-state operations established, the industry is on the cusp of entering a scale-driven phase. However, unpredictability remains a constant, with competitive dynamics as manufacturers vie for market share.

While there is vast potential within the LiDAR industry, securing a stake in this rapidly expanding domain will not be without its challenges. The competitive landscape features not only established rivals within the sector but also alternative technological approaches, intensifying the rush toward market leadership. The added pressure from automotive manufacturers seeking cost-effective solutions makes survival the foremost priority for players in this space. Thus, companies must strategically navigate these turbulent waters to thrive.

This situation reflects a broader global market trend. As competition persists, the definitive industry landscape remains yet to be fully realized. The prevailing narrative suggests that companies capable of rapid technological evolution, advanced performance, and effective cost management are those most likely to emerge victorious in future battles.